Officials expect the world economy to continue its downward spiral in the first half of 2023. In the second half of the year, the world economy is expected to bottom out and rebound under the assumption that the impact of the epidemic will wane and inflationary pressures will moderate.

In 2022, China's electronic information manufacturing industry production stable growth, export scale growth rate, enterprise efficiency gradually recovered, investment growth rate remains high.

Global semiconductor industry sales in December 2022 remain low, and the World Semiconductor Trade Statistics (WSTS) expects global sales of $580.1 billion in 2022 and about $556.5 billion in 2023.

From the capital market indices, the Philadelphia Semiconductor Index rose 14.62% year-over-year in January, and the China Semiconductor (SW) Industry Index rebounded slightly by 8.62%, reversing market optimism.

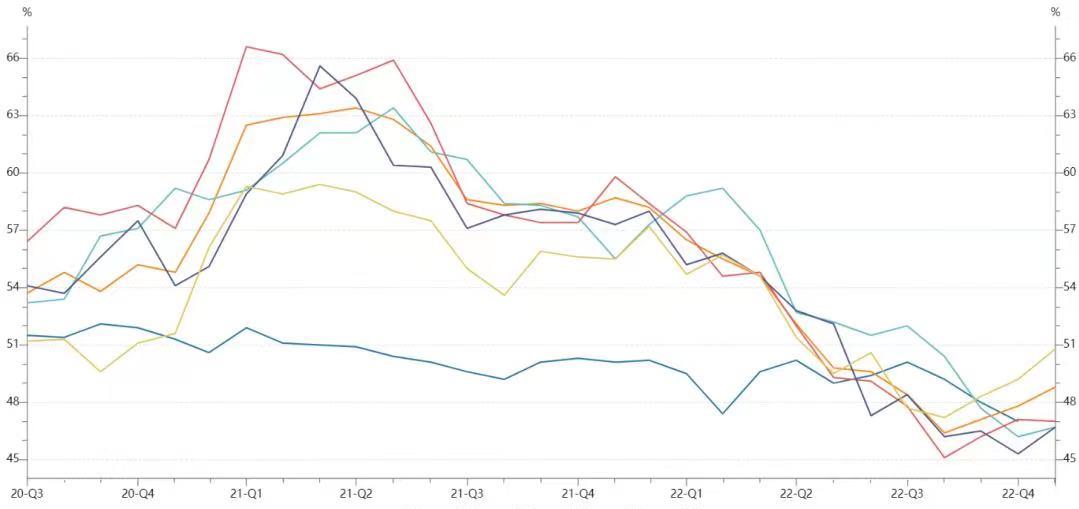

In January, the global chip delivery cycle continued to turn back, and widespread supply chain issues are improving significantly as the industry enters a new inventory adjustment cycle.

From the perspective of 2022 delivery time and price for each segment, most of the categories have generally been adjusted downward, but there will still be a shortage of automotive-grade chips, and some power semiconductors have extended their delivery time to 39~64 weeks.

January orders and inventory

From the perspective of corporate orders and actual inventory, orders are still quite weak, prices continue to fall, and customers maintain a wait-and-see attitude. Among them, Infineon, TI and Microchip as the representative of the manufacturers delivery schedule shrink significantly.

Original manufacturer

In January, the head manufacturers continue to be optimistic about the demand for new energy vehicles, industrial and other fields, internal adjustment layout speed up.

In January, the decline in foundry capacity accelerated due to end-order demand.

In January, 2022 head distribution revenue reached a record high, and the industry expects industry inventory de-stocking to be completed in the second half of 2023.

In January, industrial control opened a new round of price increases, traditional automotive tier1 accelerate the transition to autonomous driving, consumer electronics manufacturers overseas layout speed up.

Consumer Electronics

Global smartphone and PC shipments both hit record lows in 2022, and demand continues to be sluggish. 023Q1 supply chain is expected to remain low.

Summary

In January, the industry inventory de-stocking accelerated, Q1 will enter the passive de-stocking phase, is expected to gradually restore terminal demand in Q3, inventory pressure to ease.

中文版摘自芯八闻